GLOSSARY

calculation of the valuation of a start-up for a fund raising

Definition : Fundraising

Fund raising concerns mainly start-ups, it is an unavoidable subject concerning them. A fund raising is an operation to increase the company's capital subscribed by new investors or investors already present in the capital of the start-up but agreeing to increase their participations.

How does fundraising work in a start-up?

The first step is to identify potential future investors for the start-up. It is therefore necessary to be well prepared to convince investors to participate in the financing, in particular through a business plan. These investors will be interested in the company's potential for added value, and will therefore analyze the concept, the team, the market but also the initial and potential exit value. This is where the valuation of the start-up comes in.

The valuation of the start-up is therefore essential in a fundraising project in order to know how much financing the young company will need.

Why does the start-up valuation calculation require a particular expertise?

Start-ups cannot be valued as a business valued like a business or any other company. or any other company. Indeed, they are often very young and growing companies.

Problem: this type of structure cannot be evaluated according to traditional criteria such as :

- Lhe enhancement of heritage ;

- Valuation based on historical performance (margins, EBITDA, etc.);

- Lhe valuations based on the turnover (CA).

But then, how to value my start-up?

Start-ups evolve in a very unpredictable context that requires special, modern, but also riskier valuation expertise.

One must therefore rely on the growth of the start-up and the expected benefits... All the appraisals are based on a projected scenario.

However, this does not mean that the start-up's valuation calculation is based on wishful thinking: there are concrete elements that allow forreliable projections.

Be contacted by a XVAL consultant for a valuation: https://xval.fr/

What criteria do experts take into account to value a start-up?

The first criterion evaluated by the experts in start-up valorisation: the people gathered around the project.

The cohesion of the team, the skills of its members, the diverse experiences, the complementarity, the morale, the motivation...

All these criteria are taken into account by investors and experts who value a start-up.

The presence of experienced contractors is also a major asset.

But that's not all: the coherence of the project is also a key factor. In this context, start-up valuation experts evaluate the market characteristics, the project's innovations, its concept, the progress in research and product development, the business model and the start-up's competitive advantages.

Finally, the valuation experts examine the financial forecast, paying particular attention to the income statement and the cash flow plan.

Once these elements are obtained, we can apply financial valuation methods to start-ups.

What are the financial methods for valuing start-ups?

As mentioned above, the traditional traditional valuation methods do not work to do not work to evaluate the future of a start-up. That's why there are financial tools used by valuation experts to project the returns of each start-up. These include Discounted Cash-Flow, Venture Capital and the comparative approach.

To be contacted by a XVAL consultant for a start-up valuation: https://xval.fr/

1. What is the Discounted Cash-Flow (DCF) calculation method?

Very popular, the Discounted Cash-Flow method must be used with caution. It is indeed not very well adapted to very young start-ups and is rather intended for start-ups that are already well developed.

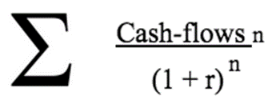

The DCF valuation requires the start-up's business plan and a cash flow projection. The DCF formula is as follows:

In this formula, the cash flows are the financial flows generated by the start-up according to the business plan.

"r" is a discount rate that calculates the present value of a future stream, while "n" is a time horizon in years.

The Epsilon end value allows the business plan to be updated continuously over several years.

Warning: this method is not suitable for all situations. First of all, it is based on projections that may include a significant margin of error depending on market trends, etc.

Moreover, it is not adapted to very young start-ups. Indeed, many young start-ups invest a lot at the beginning in order to boost their growth.

Therefore, this strategy of calculating the valuation of the start-up completely distorts the DCF model (which then displays very pessimistic forecasts) and makes it impossible to anticipate the cash flows of the start-up once it is more established.

2. What is the comparative approach to start-up valuation?

A simple but effective method is to compare your start-up to similar start-ups, with more or less the same age, the same turnover, a comparable project and targeting a similar market.

This method can be particularly interesting if a start-up similar to yours has recently raised funds. It allows you to know quickly if your project is potentially promising.

However, this is a double-edged method of calculating valuation: when faced with a start-up very similar to yours that has raised a substantial amount of money, you may already be out of the game...

On the other hand, if your start-up is truly disruptive and has no direct competitor, the comparative method will not help you much.

3. What is Venture Capital (VC) valuation?

The Venture Capital (VC) valuation method is based on the investor's point of view, which is based on the expected returns of your company. We talk about pre-money value (value of the company before raising funds) and post-money value (value of the company after raising funds).

The investor determines the post-money value based on his knowledge of the market, but also on his own return objectives.

Together with the post-money value, it determines the pre-money value.

Example: An investor estimates that your company is worth 9 million euros (pre-money value) and decides to invest 1 million euros in it. The post-money value of your company becomes 10 million euros. But the investor expects that his investment will be diluted by future fundraising (at 20%). Taking the pre-money value, he makes this calculation:

9 M € - 20% = 7,2 M €

The investor estimates the value of your start-up at 7.2 million euros. Once again, this method is based on projections and estimates of investors who may be more or less wrong. This is why it is important to have an expert to value your start-up reliably.

In order to proceed with the valuation of your start-up in a fast, confidential and individualized way, you can contact an expert XVAL consultant via the form below.

EVALUATION OF YOUR COMPANY

WITHIN 3 DAYS - 499€. HT *

Personalized study within 3 days

Several evaluation methods

Confidential and personalized

Xval Valuation

Order a company evaluation (secure payment by STRIPE)

MAKE AN APPOINTMENT WITH A CONSULTANT?

Get a detailed evaluation within 3 days: confidential / fast / personalized

THEY TRUSTED US

"A quick contact"

"Accurate and detailed"

"A great help."