The valuation of a company in turnaround

The characteristics of a turnaround company The characteristics of a company in turnaround usually limit the classical methods of valuation for a buyer because of the following elements :

- A history of loss history for the years prior to the acquisition

- The need for structural/strategic change that limits the capacity to projection

- A debt greater than or equal to the economic value of the company

In view of this, one possible approach for a buyer of a company in difficulty is to of a company in difficulty is to assimilate the value of the company to the value of a call option that can be exercised by the exercised by the buyer and to use the Black-Sholes model (1973) to define the to define the value of this company.

In this logic, we evaluate the possibility for the buyer of the option in X years if the economic value of the company exceeds the value of the debt. the economic value of the company exceeds the value of the debt.

If not, it will be in his interest to stop the activity.

To illustrate the case, we can imagine a company with a current asset value of 1 MEUR, a debt of 2MEUR at 5 years, with an estimated volatility of the result estimated at 25% (Monte Carlo method based on some key parameters). parameters).

At this point in time, the value of the shares could be considered worthless. worth nothing. Nevertheless, in 5 years, it is possible that the company will be worth the company is worth 3 MEUR with a constant debt to be repaid of 2MEUR. The value of the company for the potential buyer can therefore be estimated on the the possibility to exercise this option in 5 years.

It is also interesting to note that a higher volatility of the result is potentially in the interest of the buyer who, because of the limited liability of the shareholder, is able to volatility of the result is potentially in the interest of the buyer who, because of the limited liability of the shareholder, blocks his risk of loss while the potential for gain is potentially shareholder's limited liability, the risk of loss is blocked, whereas the potential for gain is potentially unlimited.

The experts of Wexlinks.fr and Xval.fr remain at your disposal to to accompany you at every stage of your project to take over a company in difficulty. company in difficulty.

The Black-Scholes-Merton model

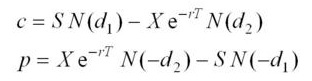

For theoretical information, the formula of the Black-Scholes-Merton model :

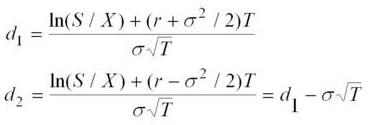

Equation C estimates the price of a call option (call option) while the P equation calculates the price of a put option (put option). In addition, the variables d1 and d2 have their own formula in this model:

At first glance, this formula is imposing but it is enough to explain each of the 5 variables used

of the 5 variables used:

S = Current

price of the company

X = Exercise price of the option

T = Time to expiration of the option, as a percentage of one year

r = Risk-free interest rate

σ = Implied volatility of the stock price, measured as a decimal

- Commercial lease

- Miscellaneous contracts :

- general terms and conditions of sale (GTC),

- employment contracts,

- insurance policies,

- commercial contracts,

- concessions or operating licenses,

- lease management contract.

- Title deeds to the company's real estate. (if applicable)

- Participations held. (if applicable)

- Industrial property rights (patents, licenses, trademarks). (if applicable)

- Administrative authorization or license (patents, licenses, trademarks). (if it is a regulated activity)

- Personnel status: organization chart, seniority, remuneration, age pyramid, non-competition clauses in employment contracts, etc.

- State of the main equipment in case of value (list, date of acquisition, condition, etc.).

- Product/service catalog and prices.

- List of pending litigation or lawsuits.

A quote for a business valuation:

==> Take advantage of our valuation offer XVAL.fr : here

==> Take advantage of our support for the transfer or takeover of a company, wexlinks.fr : here